Under the requirements of The International Tax Co-Operation (Economic Substance) Act (2021 Revision) (the “ES Act”) , all companies, limited liability companies, limited liability partnerships incorporated or registered under the applicable acts in the Cayman Islands, as well as non-Cayman Islands companies registered as foreign companies under the Companies Act in the Cayman Islands (collectively “Relevant Entity(ies)”) are required to file an economic substance return (“ES Return”) to demonstrate their compliance with the economic substance test in respect of the Relevant Activities that carried out during a financial year. Each Relevant Entity must submit its ES Return to the Cayman Islands Tax Information Authority (the “TIA”) via the Department for International Tax Co-Operation of the Cayman Islands Government (“DITC”) portal within 12 months of the relevant financial year end.

As per the Industry Advisory dated 11 January 2021 issued by the Cayman Islands Government (the “Advisory”), for Relevant Entities which are carrying on any of the Relevant Activities except IP Business and reporting on a period ending any time between 31 December 2019 and 30 April 2020 (both dates inclusive), the deadline has been extended to 30 April 2021.

A copy of the Advisory could be located via the below link:

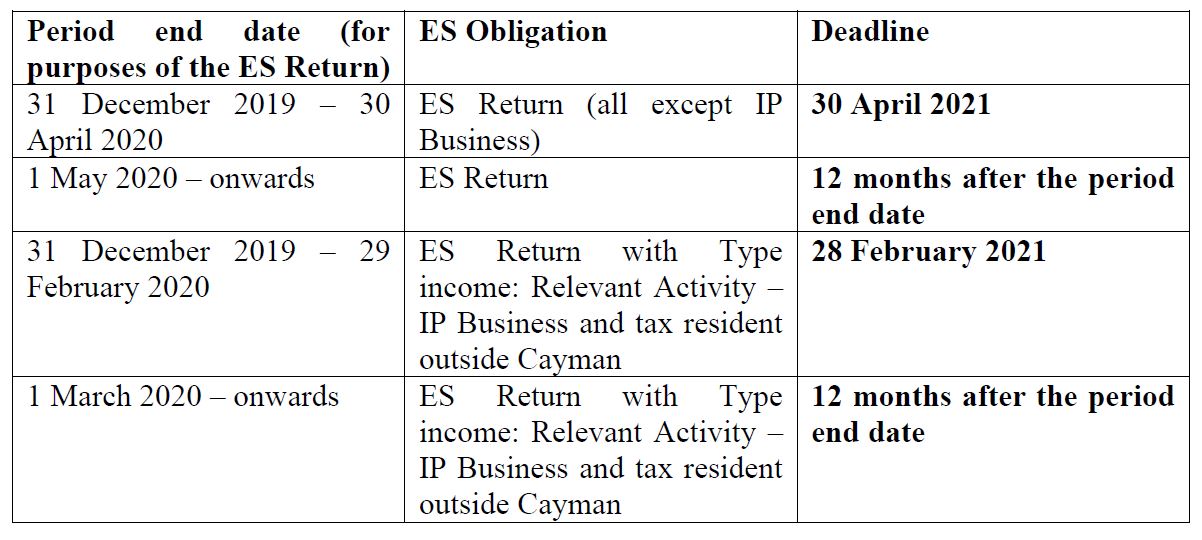

Set out below is the summary of economic substance reporting deadlines which extracted from the Advisory for easy reference.

Failure to satisfy ES Return

Where a Relevant Entity, that is required to satisfy the economic substance test, fails to prepare and submit to the TIA the required ES Return within the specified time, the TIA shall by notice in writing impose a penalty of five thousand dollars (CI$5,000) and an additional penalty of five hundred dollars (CI$500) for each day during which the failure to comply continues.

If you have any questions regarding the above, please feel free to contact your Sertus Client Services Representative or contact us at info@sertus-inc.com.

Disclaimer

Kindly note that this eNews is not exhaustive but just intended to provide a general reference. This is not a legal advice and should not be regarded as a substitute for a specific legal advice that meet your circumstances. Sertus does not accept any responsibility for any errors or omissions of the contents of this eNews.